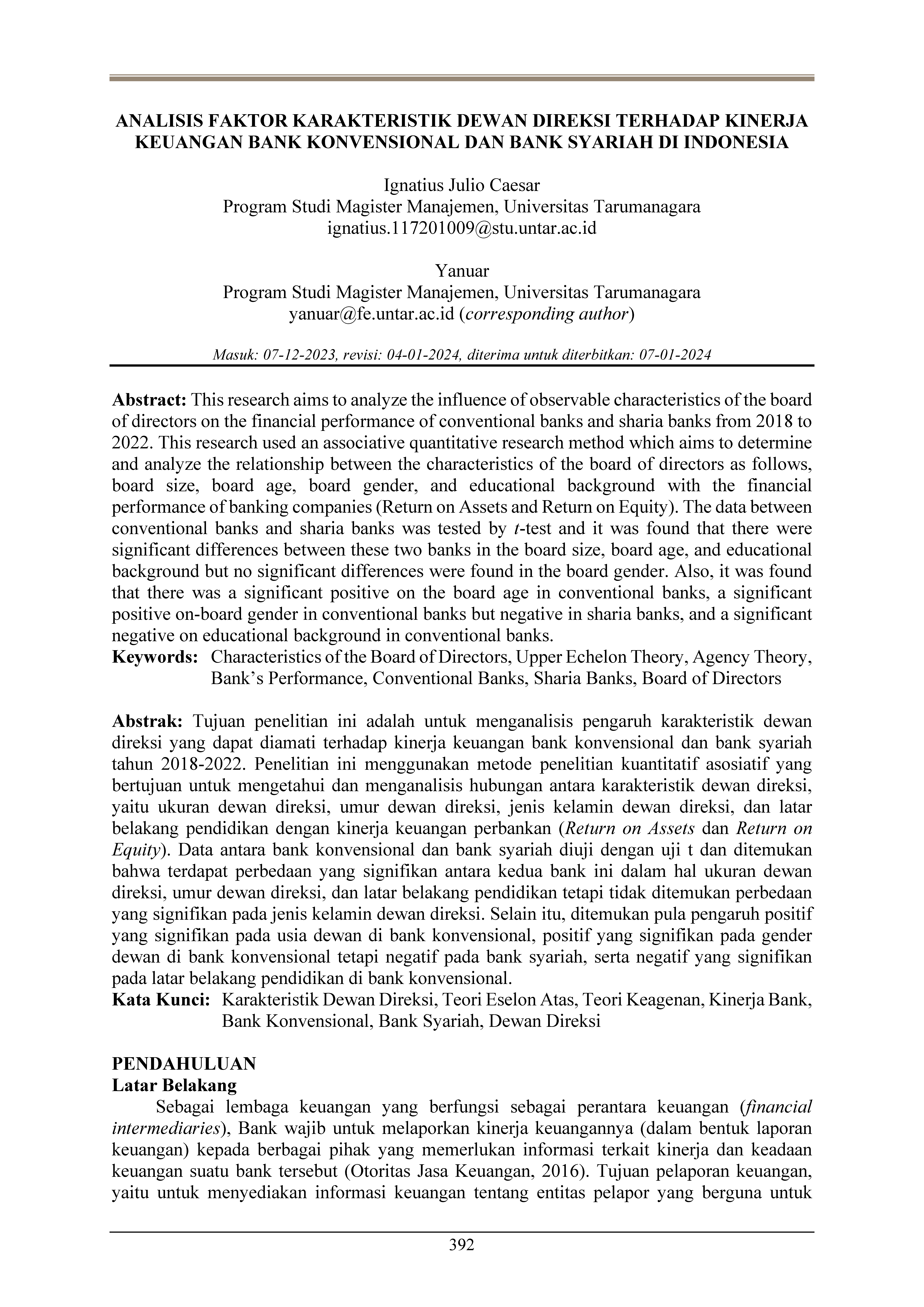

Analisis faktor karakteristik dewan direksi terhadap kinerja keuangan bank konvensional dan bank syariah di Indonesia

Main Article Content

Abstract

This research aims to analyze the influence of observable characteristics of the board of directors on the financial performance of conventional banks and sharia banks from 2018 to 2022. This research used an associative quantitative research method which aims to determine and analyze the relationship between the characteristics of the board of directors as follows, board size, board age, board gender, and educational background with the financial performance of banking companies (Return on Assets and Return on Equity). The data between conventional banks and sharia banks was tested by t-test and it was found that there were significant differences between these two banks in the board size, board age, and educational background but no significant differences were found in the board gender. Also, it was found that there was a significant positive on the board age in conventional banks, a significant positive on-board gender in conventional banks but negative in sharia banks, and a significant negative on educational background in conventional banks.

Tujuan penelitian ini adalah untuk menganalisis pengaruh karakteristik dewan direksi yang dapat diamati terhadap kinerja keuangan bank konvensional dan bank syariah tahun 2018-2022. Penelitian ini menggunakan metode penelitian kuantitatif asosiatif yang bertujuan untuk mengetahui dan menganalisis hubungan antara karakteristik dewan direksi, yaitu ukuran dewan direksi, umur dewan direksi, jenis kelamin dewan direksi, dan latar belakang pendidikan dengan kinerja keuangan perbankan (Return on Assets dan Return on Equity). Data antara bank konvensional dan bank syariah diuji dengan uji t dan ditemukan bahwa terdapat perbedaan yang signifikan antara kedua bank ini dalam hal ukuran dewan direksi, umur dewan direksi, dan latar belakang pendidikan tetapi tidak ditemukan perbedaan yang signifikan pada jenis kelamin dewan direksi. Selain itu, ditemukan pula pengaruh positif yang signifikan pada usia dewan di bank konvensional, positif yang signifikan pada gender dewan di bank konvensional tetapi negatif pada bank syariah, serta negatif yang signifikan pada latar belakang pendidikan di bank konvensional.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

This work is licensed under a Jurnal Manajemen Bisnis dan Kewirausahaan Creative Commons Attribution-ShareAlike 4.0 International License.

References

Andoh, J. A. N., Abugri, B. A., & Anarfo, E. B. (2023). Board characteristics and performance of listed firms in Ghana. Corporate Governance (Bingley), 23(1), 43–71. https://doi.org/10.1108/CG-08-2020-0344

Assenga, M. P., Aly, D., & Hussainey, K. (2018). The impact of board characteristics on the financial performance of Tanzanian firms. Corporate Governance (Bingley), 18(6), 1089–1106. https://doi.org/10.1108/CG-09-2016-0174

Belkhir, M. (2009). Board of directors’ size and performance in the banking industry. International Journal of Managerial Finance, 5(2), 201–221. https://doi.org/10.1108/17439130910947903

Bukair, A. A., & Rahman, A. A. (2015). Bank performance and board of directors attributes by Islamic banks. International Journal of Islamic and Middle Eastern Finance and Management, 8(3), 291–309. https://doi.org/10.1108/IMEFM-10-2013-0111

Darmadi, S. (2013). Board members’ education and firm performance: Evidence from a developing economy. International Journal of Commerce and Management, 23(2), 113–135. https://doi.org/10.1108/10569211311324911

Elgadi, E., & Ghardallou, W. (2022). Gender diversity, board of director’s size and Islamic banks performance. International Journal of Islamic and Middle Eastern Finance and Management, 15(3), 664–680. https://doi.org/10.1108/IMEFM-09-2019-0397

Ghardallou, W., Borgi, H., & Alkhalifah, H. (2020). CEO characteristics and firm performance: A study of Saudi Arabia listed firms. Journal of Asian Finance, Economics and Business, 7(11), 291–301. https://doi.org/10.13106/jafeb.2020.vol7.no11.291

Ghayad, R. (2008). Corporate governance and the global performance of Islamic banks. Humanomics, 24(3), 207–216. https://doi.org/10.1108/08288660810899368

Gibson, C. H. (2009). Financial reporting & analysis: Using financial accounting information (11th ed.). South-Western Cengage Learning.

Gupta, N., & Mahakud, J. (2020). CEO characteristics and bank performance: Evidence from India. Managerial Auditing Journal, 35(8), 1057–1093. https://doi.org/10.1108/MAJ-03-2019-2224

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. The Academy of Management Review, 9(2), 193–206. https://doi.org/10.2307/258434

Hosny, K., & Elgharbawy, A. (2022). Board diversity and financial performance: Empirical evidence from the United Kingdom. Accounting Research Journal, 35(4), 561–580. https://doi.org/10.1108/ARJ-02-2020-0037

Ikatan Akuntan Indonesia. (2017). Standar akuntansi keuangan 2017. Ikatan Akuntan Indonesia.

Jabari, H. N., & Muhamad, R. (2020). Gender diversity and financial performance of Islamic banks. Journal of Financial Reporting and Accounting, 19(3), 412–433. https://doi.org/10.1108/JFRA-03-2020-0061

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Kaur, R., & Singh, B. (2019). Do CEO characteristics explain firm performance in India? Journal of Strategy and Management, 12(3), 409–426. https://doi.org/10.1108/JSMA-02-2019-0027

Kupperschmidt, B. R. (2000). Multigeneration employees: Strategies for effective management. The Health Care Manager, 19(1), 65–76. https://doi.org/10.1097/00126450-200019010-00011

Lawrence, A. T., & Weber, J. (2008). Business and society: Stakeholders, ethics, public policy (12th ed.). McGraw-Hill.

Lindorff, M., & Jonson, E. P. (2013). CEO business education and firm financial performance: A case for humility rather than hubris. Education and Training, 55(4), 461–477. https://doi.org/10.1108/00400911311326072

Lipton, P., & Herzberg, A. (2006). Understanding company law 06778 (13th ed.). Thomson Lawbook.

MacCrimmon, K. R., Wehrung, D. A., & Stanbury, W. T. (1986). Taking risks: The management of uncertainty. The Free Press.

Macionis, J. J. (2007). Sociology (11th ed.). Pearson Prentice-Hall.

Martani, D., Siregar, S. V., Wardhani, R., Farahmita, A., & Tanujaya, E. (2016). Akuntansi keuangan menengah berbasis PSAK (2nd ed.). Salemba Empat.

Otoritas Jasa Keuangan. (2014). Peraturan Otoritas Jasa Keuangan Nomor 33 /POJK.04/2014 Tentang Direksi Dan Dewan Komisaris Emiten Atau Perusahaan Publik. https://www.ojk.go.id/id/regulasi/otoritas-jasa-keuangan/peraturan-ojk/Documents/POJK33DireksidanDewanKomisarisEmitenAtauPerusahaanPublik_1419319443.pdf

Otoritas Jasa Keuangan. (2016). Peraturan Otoritas Jasa Keuangan Nomor 32 /POJK.03/2016 tentang Perubahan Atas Peraturan Otoritas Jasa Keuangan Nomor 6/POJK.03/2015 tentang Transparansi dan Publikasi Laporan Bank. https://peraturan.bpk.go.id/Download/135029/POJK Nomor 32 Tahun 2016.pdf

Otoritas Jasa Keuangan. (2017). Peraturan Otoritas Jasa Keuangan Nomor 3 /POJK.05/2017 Tentang Tata Kelola Perusahaan Yang Baik Bagi Lembaga Penjamin. https://peraturan.bpk.go.id/Details/129732/peraturan-ojk-no-3pojk052017-tahun-2017

Presiden Republik Indonesia. (1998). Undang-undang Republik Indonesia Nomor 10 Tahun 1998 tentang Perubahan atas Undang-undang Nomor 7 Tahun 1992 tentang Perbankan. https://www.bphn.go.id/data/documents/98uu010.pdf

Presiden Republik Indonesia. (2007). Undang-Undang Republik Indonesia Nomor 40 Tahun 2007 tentang Perseroan Terbatas. https://www.ojk.go.id/sustainable-finance/id/peraturan/undang-undang/Documents/5. UU-40-2007 PERSEROAN TERBATAS.pdf

Presiden Republik Indonesia. (2008). Undang-Undang Republik Indonesia Nomor 21 Tahun 2008 Tentang Perbankan Syariah. https://ojk.go.id/waspada-investasi/id/regulasi/Pages/Undang-Undang-Nomor-21-Tahun-2008-Tentang-Perbankan-Syariah.aspx#:~:text=Undang-Undang Nomor 21 Tahun 2008 Tentang Perbankan Syariah,-16 Juli 2008&text=Ketentuan fungsi bank syariah juga,kebersamaan%2C

Rahman, M. J., & Chen, X. (2023). CEO characteristics and firm performance: Evidence from private listed firms in China. Corporate Governance (Bingley), 23(3), 458–477. https://doi.org/10.1108/CG-01-2022-0004

Robbins, S. P., & Judge, T. A. (2015). Perilaku organisasi (R. Saraswati (trans.); 16th ed.). Salemba Empat.

Samsudin, S. (2006). Manajemen sumber daya manusia. Pustaka Setia.

Schermerhorn, J. R., & Bachrach, D. G. (2015). Introduction to management. John Wiley & Sons.

Sudana, I. M. (2011). Manajemen keuangan perusahaan: Teori & praktik (N. I. Sallama (ed.); 2nd ed.). Erlangga.

Suherman, Mahfirah, T. F., Usman, B., Kurniawati, H., & Kurnianti, D. (2023). CEO characteristics and firm performance: Evidence from a Southeast Asian country. Corporate Governance (Bingley), 23(7), 1526–1563. https://doi.org/10.1108/CG-05-2022-0205

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185–211. https://doi.org/10.1016/0304-405X(95)00844-5